PREPARING FOR TAX DAY

Use these tips to help you prepare for your appointment

What should you do to prepare for your appointment?

Required documents to keep on file:

Copies of Drivers License or State IDs

Social Security Cards

Proof of Residence for dependents claiming EIC

Income documents:

Income from jobs: forms W-2 for you and your spouse

Investment income—various forms 1099 (-INT, -DIV, -B, etc.), K-1s, stock option information

Income from state and local income tax refunds and/or unemployment: forms 1099-G

Taxable alimony received

Business or farming income—profit/loss statement, capital equipment information

If you use your home for business—home size, office size, home expenses, office expenses

IRA/pension distributions—forms 1099-R, 8606

Rental property income/expense—profit/Loss statement, rental property suspended loss information

Social Security benefits—forms SSA-1099

Income from sales of property—original cost and cost of improvements, escrow closing statement, cancelled debt information (form 1099-C)

Prior year installment sale information—forms 6252, principal and Interest collected during the year, SSN and address of payer

Other miscellaneous income—jury duty, gambling winnings, Medical Savings Account (MSA), scholarships, etc.

(Use our handy IRS document search tool for your documents)

How can I check on my tax refunds? Tax Related Web-sites/phone numbers:

IRS www.irs.gov IRS Get Refund Status IRS Inquiry Phone: (800) 829-1040

Other tax documents:

IRA contributions

Energy credits

Student loan interest

Medical Savings Account (MSA) contributions

Moving expenses (for tax years prior to 2018 only)

Self-employed health insurance payments

Keogh, SEP, SIMPLE and other self-employed pension plans

Alimony paid that is tax dedcutible

Educator expenses

State and local income taxes paid

Real estate taxes paid

Personal property taxes—vehicle license fee based on value

Estimated tax payment made during the year, prior year refund applied to current year, and any amount paid with an extension to file.

Direct deposit information—routing and account numbers

Foreign bank account information—location, name of bank, account number, peak value of account during the year

Tax deduction documents:

Advance Child Tax Credit payment

Letter 6419, Advance Child Tax Credit Reconciliation

If you received 'Your Third Economic Impact Payment', Letter 6475

Child care costs—provider’s name, address, tax id, and amount paid

Education costs—forms 1098-T, education expenses

Adoption costs—SSN of child, legal, medical, and transportation costs

Home mortgage interest and points you paid—Forms 1098

Investment interest expense

Charitable donations—cash amounts and value of donated property, miles driven, and out-of-pocket expenses

Casualty and theft losses—amount of damage, insurance reimbursements

Other miscellaneous tax deductions—union dues, unreimbursed employee expenses (uniforms, supplies, seminars, continuing education, publications, travel, etc.) (for tax years prior to 2018 only)

Medical and dental expenses

CURRENT TAX RATES

Current rates information provided by IRS

2023 Tax Brackets

Income Tax Brackets and Rates

The 2023 income ceiling for all listed tax brackets and for all filers, adjusted for inflation are listed below. The Seven federal income tax rates for 2023 are... 10% - 12% - 22% - 24% - 32% - 35% - 37% The marginal income tax rate of 37% will apply to taxpayers with taxable income above $539,900 (single filers), and $693,750 is the target for married couples filing jointly...(SEE Table 1)

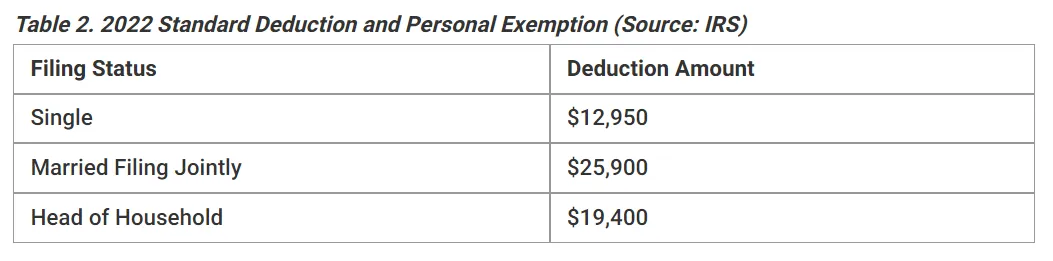

Standard Deduction and Personal Exemption

2023 has standard deductions for single filers increasing by $900; $1800 for married couples filing jointly. Personal exemptions for 2023 remains at ZERO (this is due to the personal exemption from the

Alternative Minimum Tax

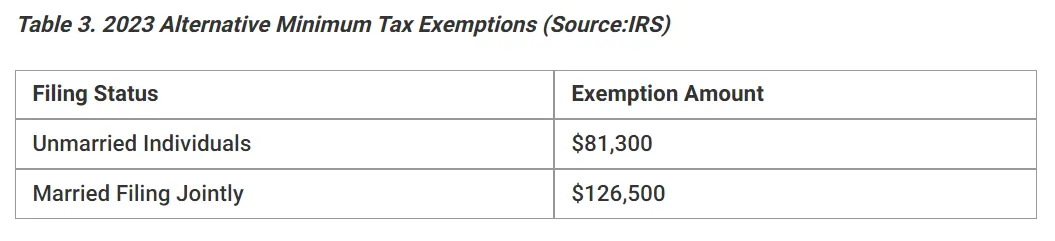

Created in the 1960s, The Alternative Minimum Tax (AMT) was setup to prevent high-income taxpayers from avoiding the individual income tax. This parallel tax income system requires high-income taxpayers to calculate their tax bill twice: once under the ordinary income tax system and again under the AMT. The taxpayer then needs to pay the higher of the two. More information can be found at IRS.Gov (SEE Table 3).

2023 still sees the AMT rate at 28%. This rate applies to excess AMTI of $220,700 for all taxpayers ($110,350 for married couples who file separate returns).

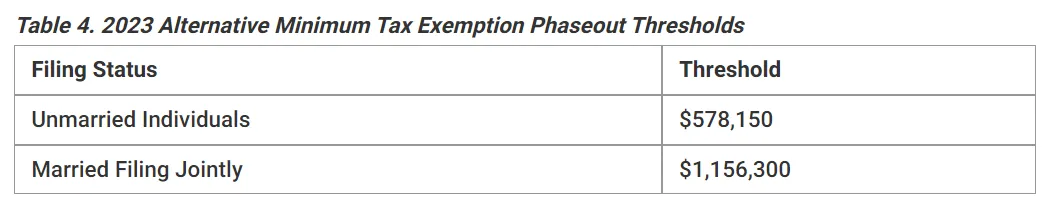

The AMT exemptions phase out at 25 cents per dollar earned once a taxpayers AMTI hits a certain threshold. In 2023, the exemption will start phasing out at $578,150 in AMTI for single filers and $1,156,300 for married taxpayers filing jointly (SEE Table 4).

Earned Income Tax Credit

The 2023 Maximum Earned Income Tax Credit (EITC) for single and joint filers is $560 (no children) (SEE Table 5). The maximum credit is $3,995 for one child, $6,604 for two children, and $7,430 for three or more children. Increases are nominal.

Qualified Business Income Deduction

Within the Tax Cuts and Jobs Act, there is an inclusion of a 20 percent deduction in 2023 for pass-through businesses with $182,100 of qualified business income for single taxpayers and $364,200 for married taxpayers filing jointly (SEE Table 6).

2023 Capital Gains Tax Rates & Brackets (Long-term Capital Gains)

Capital Gains, long term, are taxed using different rates and brackets compared to standard income.

Child Tax Credit

The maximum Child Tax Credit for 2023 is $2,000 per child who qualifies, with no adjustments for inflation. The amount that may be refunded for the Child Tax Credit is adjusted for inflation and increases from $1,500 to $1,600 in 2023.

2023 Annual Exclusion for Gifts

For 2023, the first $17,000 of gifts to any person is excluded from tax. Exclusions are increased to $175,000 from $164,000 in 2023 for gifts to spouses who are not citizens of the United States.

2022 Tax Brackets

Income Tax Brackets and Rates

2022 income limits for all tax brackets and all filers, adjusted for inflation. Seven federal income tax rates in 2022 are as follows: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. The marginal income tax rate of 37 percent will only apply to taxpayers with taxable income above $539,900 (single filers), and $647,850 is the target for married couples filing jointly...(SEE Table 1)

Standard Deduction and Personal Exemption

Standard deductions for single filers has increased by $400; $800 for married couples filing jointly. The personal exemption for 2022 remains eliminated (this is due to the personal exemption from the

Alternative Minimum Tax

Created in the 1960s, The Alternative Minimum Tax (AMT) was setup to prevent high-income taxpayers from avoiding the individual income tax. This parallel tax income system requires high-income taxpayers to calculate their tax bill twice: once under the ordinary income tax system and again under the AMT. The taxpayer then needs to pay the higher of the two. More information can be found at IRS.Gov (SEE Table 3).

In 2022, the 28% AMT rate applies to excess AMTI of $206,100 for all taxpayers ($103,050 for married couples filing separate returns).

AMT exemptions phase out at 25 cents per dollar earned once taxpayer AMTI hits a certain threshold. In 2022, the exemption will start phasing out at $539,900 in AMTI for single filers and $1,079,800 for married taxpayers filing jointly (SEE Table 4).

Earned Income Tax Credit

The 2022 Maximum Earned Income Tax Credit (EITC) for single and joint filers is $560 (no children) (SEE Table 5). The maximum credit is $3,733 for one child, $6,164 for two children, and $6,935 for three or more children. These are small increases compared to 2021.

Qualified Business Income Deduction

The Tax Cuts and Jobs Act includes a 20 percent deduction in 2022 for pass-through businesses with $170,050 of qualified business income for single taxpayers and $340,100 for married taxpayers filing jointly

(SEE Table 6).

2022 Capital Gains Tax Rates & Brackets (Long-term Capital Gains)

Capital Gains, long term, are taxed using different rates and brackets compared to standard income.

Child Tax Credit

The maximum Child Tax Credit for 2022 is $2,000 per child who qualifies, and is not adjusted for inflation. The portion refundable for the Child Tax Credit is adjusted for inflation and will increase from $1,400 to $1,500 in 2022.

2023 Annual Exclusion for Gifts

For 2022, the first $16,000 of gifts to any person is excluded from tax, up from $15,000 in 2021. This exclusion is increased to $164,000 from $159,000 for gifts to spouses who are not citizens of the United States.

TAX RECORDS RETENTION

Tax record retention times

WHEN IN DOUBT, DON'T THROW IT OUT

Federal law requires you to maintain copies of your tax returns and supporting documents for three years. This is called the “three-year law” and leads many people to believe they're safe provided they retain their documents for this period of time. Even if the original records are provided only on paper, they can be scanned and converted to a digital format. Once the documents are in electronic form, taxpayers can download them to a backup storage device, such as an external hard drive, or burn them onto a CD or DVD (don't forget to label it). Create a Backup Set of Records and Store Them Electronically. Keeping a backup set of records — including, for example, bank statements, tax returns, insurance policies, etc. — is easier than ever now that many financial institutions provide statements and documents electronically, and much financial information is available on the Internet. You might also consider online backup, which is the only way to ensure that data is fully protected. With online backup, files are stored in another region of the country, so that if a hurricane or other natural disaster occurs, documents remain safe.

Caution: Identity theft is a serious threat in today's world, and it is important to take every precaution to avoid it. After it is no longer necessary to retain your tax records, financial statements, or any other documents with your personal information, you should dispose of these records by shredding them and not disposing of them by merely throwing them away in the trash.

However, if the IRS believes you have significantly underreported your income (by 25 percent or more), or believes there may be indication of fraud, it may go back six years in an audit. To be safe, use the following guidelines.

Business Documents To Keep For One Year

Correspondence with Customers and Vendors

Duplicate Deposit Slips

Purchase Orders (other than Purchasing Department copy)

Receiving Sheets

Requisitions

Stenographer's Notebooks

Stockroom Withdrawal Forms

Business Documents To Keep For Three Years

Employee Personnel Records (after termination)

Employment Applications

Expired Insurance Policies

General Correspondence

Internal Audit Reports

Internal Reports

Petty Cash Vouchers

Physical Inventory Tags

Savings Bond Registration Records of Employees

Time Cards For Hourly Employees

Business Documents To Keep For Six Years

Accident Reports, Claims

Accounts Payable Ledgers and Schedules

Accounts Receivable Ledgers and Schedules

Bank Statements and Reconciliations

Cancelled Checks

Cancelled Stock and Bond Certificates

Employment Tax Records

Expense Analysis and Expense Distribution Schedules

Expired Contracts, Leases

Expired Option Records

Inventories of Products, Materials, Supplies

Invoices to Customers

Notes Receivable Ledgers, Schedules

Payroll Records and Summaries, including payment to pensioners

Plant Cost Ledgers

Purchasing Department Copies of Purchase Orders

Sales Records

Subsidiary Ledgers

Time Books

Travel and Entertainment Records

Vouchers for Payments to Vendors, Employees, etc.

Voucher Register, Schedules

Special Circumstances

Car Records (keep until the car is sold)

Credit Card Receipts (keep with your credit card statement)

Insurance Policies (keep for the life of the policy)

Mortgages / Deeds / Leases (keep 6 years beyond the agreement)

Pay Stubs (keep until reconciled with your W-2)

Property Records / improvement receipts (keep until property sold)

Sales Receipts (keep for life of the warranty)

Stock and Bond Records (keep for 6 years beyond selling)

Warranties and Instructions (keep for the life of the product)

Other Bills (keep until payment is verified on the next bill)

Depreciation Schedules and Other Capital Asset Records (keep for 3 years after the tax life of the asset)

Personal Documents To Keep For One Year

Bank Statements

Paycheck Stubs (reconcile with W-2)

Canceled checks

Monthly and quarterly mutual fund and retirement contribution statements (reconcile with year end statement)

Personal Documents To Keep For Three Years

Credit Card Statements

Medical Bills (in case of insurance disputes)

Utility Records

Expired Insurance Policies

Personal Documents To Keep For Six Years

Supporting Documents For Tax Returns

Accident Reports and Claims

Medical Bills (if tax-related)

Property Records / Improvement Receipts

Sales Receipts

Wage Garnishments

Other Tax-Related Bills

Personal Records To Keep Forever

CPA Audit Reports

Legal Records

Important Correspondence

Income Tax Returns

Income Tax Payment Checks

Investment Trade Confirmations

Retirement and Pension Records

Business Records To Keep Forever While federal guidelines do not require you to keep tax records “forever,” in many cases there will be other reasons you'll want to retain these documents indefinitely.

Audit Reports from CPAs/Accountants

Cancelled Checks for Important Payments (especially tax payments)

Cash Books, Charts of Accounts

Contracts, Leases Currently in Effect

Corporate Documents (incorporation, charter, by-laws, etc.)

Documents substantiating fixed asset additions

Deeds

Depreciation Schedules

Financial Statements (Year End)

General and Private Ledgers, Year End Trial Balances

Insurance Records, Current Accident Reports, Claims, Policies

Investment Trade Confirmations

IRS Revenue Agents' Reports

Journals

Legal Records, Correspondence and Other Important Matters

Minute Books of Directors and Stockholders

Mortgages, Bills of Sale

Property Appraisals by Outside Appraisers

Property Records

Retirement and Pension Records

Tax Returns and Worksheets

Trademark and Patent Registrations

Copyright ©2023 | Honey Bee Tax Solutions, LLC